RIA Legal Counsel for Investment Advisers

If you’re launching or managing a Registered Investment Adviser (RIA) firm in the US, compliance is more than a requirement—it’s the foundation of your business. Kamps Legal helps RIAs navigate SEC and US DFPI regulations with practical legal guidance tailored to your advisory model.

From initial registration and Form ADV filings to marketing compliance and annual reviews, we offer responsive, strategic legal counsel that keeps your firm protected and growing.

to schedule a consultation and learn how we can help you stay compliant and competitive in a regulated industry.

What Is a Registered Investment Adviser?

A Registered Investment Adviser (RIA) is an individual or firm that provides investment advice to clients for compensation and is registered with either the Securities and Exchange Commission (SEC) or a state regulator, such as US’s Department of Financial Protection and Innovation (DFPI).

You must register as an RIA if:

You manage $100 million or more in client assets (SEC registration).

You manage under $100 million but offer services in US (state registration).

You provide personalized investment advice for compensation—even as a solo advisor.

Understanding the differences between state and federal requirements is key to establishing a compliant firm from day one.

Our RIA Legal Services

-

Form ADV Part 1 & 2 drafting and filing

Form U4 submissions for investment adviser representatives

Investment Adviser Registration Depository (IARD) system navigation

SEC vs. DFPI registration analysis and strategy

-

Compliance Manual Creation – Tailored policies and procedures for your advisory business

Form CRS Drafting & Updates – Prepare clear, compliant client relationship summaries

Annual Compliance Reviews – Mock audits and gap assessments

Marketing Compliance – Ensure advertising meets SEC Rule 206(4)-1 requirements

Fee Disclosure & Custody Rule Compliance – Help structuring client agreements and safeguarding client funds

Training & Advisory – Staff education and on-call legal support

-

SEC or state audit prep and legal counsel

Document responses and corrective action plans

Representation during investigations or enforcement actions

Kamps Legal provides end-to-end legal services for RIAs—from startup registration to ongoing compliance.

Whether you’re a solo startup or an expanding firm, our goal is to help you thrive while staying in compliance with complex regulations.

We work with RIAs across the investment advisory spectrum, including:

Solo advisers starting their own RIA firms

Small to midsize RIA firms transitioning from broker-dealer affiliations

Family offices and boutique wealth managers

Financial planners offering fee-based advice

Private fund managers and emerging investment firms

No matter your firm size, Kamps Legal provides practical legal insight backed by financial regulatory knowledge.

Who We Serve

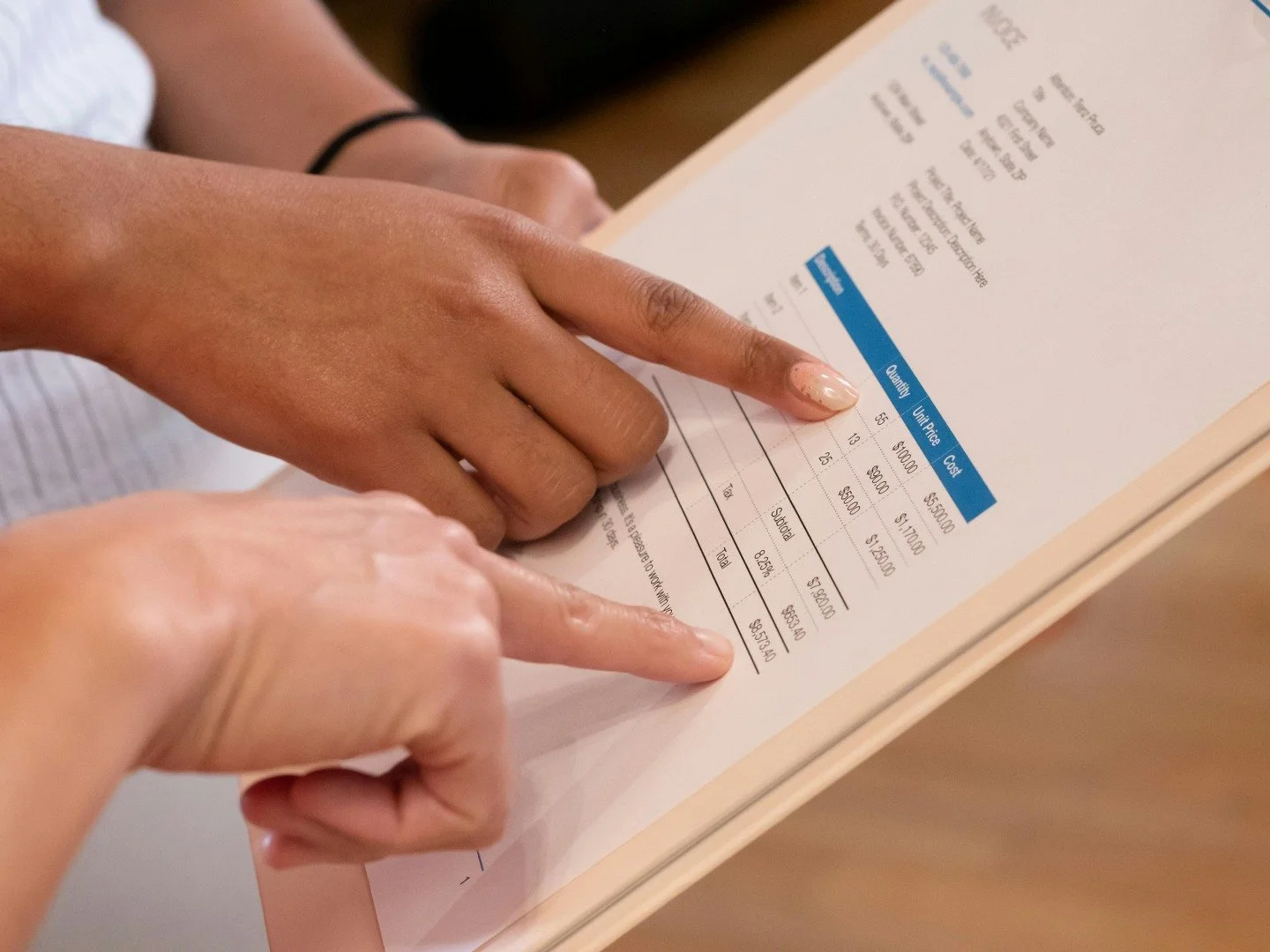

Common Legal & Compliance Pitfalls We Help Avoid

Issue

Incorrect or outdated Form ADV filings

Advertising and performance claims violations

Unclear client fee disclosures

Improper handling of custody or client funds

Lack of written policies or annual testing

How We Help

We review and file accurate updates on your behalf.

We vet materials to ensure compliance with the SEC’s marketing rule.

We help draft client agreements that are transparent and compliant.

We assist with procedures to meet the Custody Rule’s standards.

We create tailored compliance manuals and training frameworks.

Why Choose Kamps Legal?

RIA-Focused Legal Support – We understand the legal and regulatory needs of investment advisers, not just general business law.

US & SEC Compliance Knowledge – We guide clients through DFPI and SEC requirements with confidence.

Based – Local counsel who understands your market and clientele.

Personalized Service – Direct attorney access and responsive communication.

Flat-Fee & Subscription Models – Predictable pricing for ongoing compliance needs.

FAQs

-

RIA firms register with the SEC or state regulators, not FINRA. FINRA governs broker-dealers, not fee-only advisers.

-

Part 1 includes firm information and is filed electronically. Part 2 is a plain-English narrative you must deliver to clients, covering your services, fees, and potential conflicts.

-

Generally, firms managing over $100 million register with the SEC. Those managing less register with the state, such as US’s DFPI.

-

You may receive an exam notice requesting documents like policies, marketing materials, and financials. Kamps Legal can guide you through the process and ensure readiness.

Start Your RIA Journey with Confidence

If you're launching a new advisory firm or need help maintaining compliance, Kamps Legal is here to help you navigate every step of the RIA lifecycle.